Unlocking Growth in the CPG Industry: How MinervaDB’s Data Strategy Reduces Churn and Boosts Revenue Per Customer?

The consumer packaged goods (CPG) industry stands at a pivotal crossroads. On one hand, digital transformation has opened unprecedented opportunities for brands to connect with consumers, personalize experiences, and scale operations efficiently. On the other, rising competition, shifting consumer preferences, and increasingly fragmented shopping behaviors have made customer retention more challenging than ever. In this environment, traditional marketing and sales strategies are no longer sufficient. Companies that rely solely on intuition, broad segmentation, or lagging performance indicators are seeing diminishing returns—higher churn rates, stagnant customer lifetime value (CLV), and missed revenue opportunities across product categories.

Enter MinervaDB—a next-generation data strategy platform purpose-built for the complexities of the modern CPG landscape. Unlike generic analytics tools or one-size-fits-all CRM systems, MinervaDB offers a holistic, intelligence-driven approach that empowers CPG brands to understand their customers at a granular level, anticipate churn before it happens, and drive meaningful revenue growth across every category they serve.

This article explores how MinervaDB’s data strategy is transforming the way CPG companies operate—not just as a technology solution, but as a strategic enabler of sustainable growth. We’ll examine the root causes of customer churn in the CPG sector, unpack the core components of MinervaDB’s approach, and demonstrate how its implementation leads to measurable improvements in customer retention, cross-category purchasing, and overall profitability.

The Hidden Cost of Churn in the CPG Industry

Customer churn—the rate at which consumers stop purchasing from a brand—is often underestimated in the CPG world. Because many products are low-cost and frequently repurchased, companies may assume that losing a few customers here and there has minimal impact. But the reality is far more concerning.

Even a small increase in churn can erode margins significantly. Consider this: acquiring a new customer typically costs five to seven times more than retaining an existing one. In a high-volume, low-margin industry like CPG, where thin profit margins are the norm, losing loyal customers means not only lost sales but also wasted marketing spend and reduced economies of scale.

Moreover, churn isn’t always obvious. Unlike subscription-based services where non-renewal is a clear signal, CPG churn is often silent. A customer doesn’t formally cancel—they simply stop showing up. They might switch to a private label, try a competitor’s new product launch, or shift their buying behavior due to life changes, all without notifying the brand. Without sophisticated tracking and predictive analytics, these shifts go unnoticed until they manifest as declining sales figures.

The problem is compounded by the multi-category nature of most CPG portfolios. A household may buy snacks from Brand A, beverages from Brand B, and cleaning supplies from Brand C. If a CPG company only tracks purchases within a single category, it risks missing broader behavioral trends. For example, a decline in snack purchases might coincide with increased spending on health-focused alternatives—but if the brand doesn’t have visibility across categories, it cannot adapt its messaging, promotions, or product development accordingly.

Additionally, modern consumers expect personalization. They want offers that feel relevant, packaging that aligns with their values, and products that meet their evolving needs. When brands fail to deliver on these expectations, even loyal customers begin to disengage. Over time, repeated mismatches between brand communication and consumer intent lead to attrition.

Churn is not just a marketing problem—it’s a data problem. And solving it requires more than just collecting customer information; it demands a strategic framework for integrating, analyzing, and acting on that data in real time.

Why Traditional Approaches Fall Short

Many CPG companies have invested heavily in data collection—point-of-sale systems, loyalty programs, e-commerce platforms, social media monitoring, and third-party market research. Yet, despite this abundance of data, most struggle to translate insights into action.

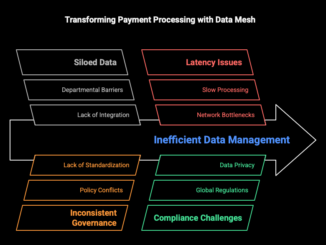

One major reason is data silos. Sales data lives in ERP systems, digital engagement metrics are trapped in marketing automation platforms, and supply chain information resides in logistics databases. These systems rarely communicate with each other, resulting in fragmented views of the customer. A shopper who buys online, redeems coupons via mobile app, and shops in-store appears as three separate profiles unless there’s a unified identity resolution layer—something most legacy systems lack.

Another limitation is the reliance on descriptive analytics—reports that tell you what happened last quarter, last month, or last week. While useful for historical analysis, these insights are inherently backward-looking. They can confirm that churn has increased, but they offer little guidance on why it happened or how to prevent it in the future.

Predictive capabilities are often rudimentary. Some brands use basic regression models to identify at-risk customers based on purchase frequency or recency. However, these models fail to account for external factors like seasonality, macroeconomic trends, competitive activity, or shifts in digital engagement. As a result, interventions come too late or target the wrong audience.

Furthermore, personalization efforts are frequently superficial. Sending a generic discount email to everyone who hasn’t purchased in 60 days may drive some short-term redemptions, but it doesn’t address the underlying reasons for disengagement. Worse, overuse of such tactics can train customers to wait for discounts, eroding brand equity and long-term profitability.

Finally, there’s a misalignment between data teams and business units. Analysts produce dashboards and reports, but marketers, product managers, and executives often lack the tools or training to interpret them effectively. Insights remain trapped in spreadsheets rather than being operationalized into campaigns, pricing strategies, or innovation pipelines.

The gap between data availability and business impact is where MinervaDB steps in—not as another analytics tool, but as a comprehensive data strategy engine designed specifically for CPG dynamics.

Introducing MinervaDB: A Purpose-Built Data Strategy for CPG

MinervaDB is not a one-dimensional solution. It’s a scalable, integrated platform that combines advanced data engineering, machine learning, and domain-specific intelligence to help CPG brands turn raw data into strategic advantage. At its core, MinervaDB operates on three foundational principles:

- Unified Customer Intelligence – Creating a single, persistent view of the customer by stitching together data from disparate sources.

- Predictive Churn Modeling – Identifying at-risk customers early using behavioral, transactional, and contextual signals.

- Revenue Optimization Across Categories – Driving higher spend per customer through intelligent cross-selling, bundling, and loyalty reinforcement.

Let’s explore each of these in detail.

1. Unified Customer Intelligence: Breaking Down Silos

The first step in any effective data strategy is integration. MinervaDB begins by ingesting and harmonizing data from a wide range of sources:

- Point-of-sale (POS) transactions from retail partners

- E-commerce platform logs

- Loyalty program activity

- Mobile app interactions

- Social media engagement

- Customer service records

- Third-party demographic and behavioral datasets

- Supply chain and inventory data

Using advanced identity resolution techniques—including probabilistic matching, deterministic linking, and fuzzy logic—MinervaDB creates a persistent customer profile that remains consistent across channels and touchpoints. This means that when a consumer buys a product in-store using a rewards card, browses the brand’s website on their phone, and later engages with a social media ad, all these interactions are attributed to a single, unified profile.

This unified view enables several critical capabilities:

- Behavioral sequencing: Understanding the path to purchase, including how digital touchpoints influence in-store decisions.

- Lifetime value modeling: Calculating CLV more accurately by incorporating cross-channel behavior and retention patterns.

- Segmentation with depth: Moving beyond basic demographics to create dynamic segments based on purchasing habits, responsiveness to promotions, category affinity, and churn risk.

For example, MinervaDB can identify a segment of “health-conscious parents” who regularly buy organic snacks but have recently reduced their frequency. By analyzing their full journey—including search behavior, coupon redemptions, and engagement with educational content—the system can determine whether this drop-off is due to a temporary life event (e.g., vacation), competitive pressure (e.g., a new entrant in the organic space), or dissatisfaction with product quality or availability.

This level of insight allows brands to move from reactive to proactive engagement—reaching out with personalized content, samples, or incentives tailored to the individual’s context, rather than blasting generic promotions to an entire segment.

2. Predictive Churn Modeling: Seeing the Future Before It Happens

Churn prediction in CPG is inherently more complex than in subscription models. There’s no explicit cancellation event; instead, churn is inferred from behavioral decay. MinervaDB addresses this challenge with a multi-layered predictive modeling framework.

The system employs machine learning algorithms trained on historical customer behavior to detect subtle patterns that precede attrition. These models go beyond simple recency-frequency-monetary (RFM) scoring by incorporating:

- Temporal dynamics: How purchase intervals change over time

- Category migration: Whether customers are shifting spend to related or substitute categories

- Engagement decay: Declines in email open rates, app logins, or social interactions

- External signals: Economic indicators, weather patterns, or regional events that may impact consumption

- Competitive exposure: Evidence of engagement with rival brands through digital footprints

Each customer is assigned a real-time churn risk score, updated daily based on new interactions (or lack thereof). These scores are then used to trigger automated workflows across marketing, sales, and customer success teams.

For instance, a customer with a rising churn risk might automatically be enrolled in a re-engagement campaign featuring:

- A personalized product recommendation based on past preferences

- A limited-time offer on a complementary item

- A survey to gather feedback on recent experiences

- A sample shipment of a new product variant

These interventions are not random—they’re optimized through A/B testing and reinforcement learning to maximize retention probability while minimizing incentive cost.

Importantly, MinervaDB also distinguishes between different types of churn:

- Situational churn: Temporary disengagement due to life changes (e.g., moving, illness, travel)

- Competitive churn: Switching to a rival brand due to price, promotion, or product innovation

- Value-based churn: Loss of perceived value, often due to poor quality, inconsistent availability, or misaligned messaging

- Category exit: Complete abandonment of a product category (e.g., quitting sugary drinks)

By classifying churn types, MinervaDB enables targeted remediation strategies. A customer experiencing situational churn might respond well to a “we miss you” message with a warm reintroduction offer, while someone lost to competition may require a product comparison or loyalty bonus to win back.

3. Revenue Optimization Across Categories: Expanding the Relationship

Reducing churn is only half the battle. To truly grow, CPG brands must increase the revenue generated per customer. This is where MinervaDB’s category intelligence engine comes into play.

Most CPG companies manage categories in isolation. The team responsible for snacks operates separately from the beverage or household care divisions. As a result, opportunities for cross-category bundling, joint promotions, or shared customer insights are often missed.

MinervaDB breaks down these internal silos by analyzing customer behavior across the entire portfolio. It identifies natural affinities between categories—such as households that buy both premium coffee and gourmet creamers, or parents who purchase baby wipes alongside diaper rash cream.

Using this insight, the platform enables:

- Smart bundling: Recommending complementary products at checkout (online or in-app)

- Tiered loyalty rewards: Offering bonus points for purchasing across multiple categories

- Lifecycle marketing: Introducing new category entries based on life stage (e.g., suggesting toddler snacks after infant food purchases)

- Dynamic pricing: Adjusting promotions based on individual price sensitivity and cross-category elasticity

For example, MinervaDB might detect that customers who buy organic pasta are 3.2x more likely to also purchase organic sauce. The system can then trigger a campaign offering a discount on sauce when pasta is added to the cart, or suggest a “complete meal kit” bundle in digital ads.

These recommendations are not static. They evolve based on real-time feedback—what works for one segment may not work for another. Machine learning continuously refines the models, ensuring that cross-selling efforts become more effective over time.

Moreover, MinervaDB helps brands identify “anchor categories”—those that drive the most repeat visits and cross-category exploration. By strengthening performance in these key areas through improved availability, innovation, or marketing support, companies can create a virtuous cycle of engagement and spending.

Operationalizing the Strategy: How MinervaDB Works in Practice

Understanding the theory is one thing; implementing it is another. MinervaDB is designed for seamless integration into existing CPG operations, with minimal disruption to current workflows.

Data Ingestion and Onboarding

The onboarding process begins with a discovery phase, where MinervaDB’s team works with the client to map all available data sources, define key business objectives, and establish success metrics. This collaborative approach ensures that the platform is aligned with strategic priorities from day one.

Next, secure APIs and ETL pipelines are configured to pull data into MinervaDB’s cloud-based data lake. All data is encrypted in transit and at rest, with strict access controls and compliance certifications (e.g., GDPR, CCPA) built into the architecture.

During ingestion, data undergoes cleansing, normalization, and enrichment. Missing values are imputed, inconsistent formats are standardized, and external datasets (e.g., Nielsen panel data, weather feeds) are blended to enhance context.

Identity Resolution and Profile Building

Once data is centralized, MinervaDB applies its identity resolution engine to unify customer records. This involves:

- Matching email addresses, phone numbers, device IDs, and loyalty IDs across systems

- Resolving household-level identities using address clustering and behavioral co-occurrence

- Handling edge cases like shared devices, guest checkouts, and anonymous browsing

The output is a rich, persistent customer graph that captures not just transactions, but relationships, preferences, and behavioral trajectories.

Model Training and Deployment

With clean, unified data in place, MinervaDB trains custom machine learning models tailored to the brand’s specific product mix, customer base, and market conditions.

Churn models are trained on historical cohorts, using features like:

- Average days between purchases

- Share of wallet within category

- Response rate to promotions

- Digital engagement frequency

- Product return or complaint history

- Basket diversity index

Similarly, recommendation engines are trained on co-purchase patterns, substitution behaviors, and seasonal trends. All models are validated using holdout datasets and continuously monitored for performance drift.

Once deployed, these models run in real time, updating scores and recommendations as new data arrives. Alerts are sent to relevant stakeholders when key thresholds are crossed—e.g., when churn risk exceeds 70% or when a high-value customer shows signs of competitive engagement.

Activation and Orchestration

Insights are only valuable if they drive action. MinervaDB integrates with existing marketing automation, CRM, and e-commerce platforms to operationalize recommendations.

For example:

- A customer identified as high-risk for churn might automatically receive a personalized email with a tailored offer via Salesforce Marketing Cloud.

- In-app messages on the brand’s mobile app could prompt users to try a new product based on their profile.

- Retail partners might receive alerts about at-risk customers in their stores, enabling associates to offer samples or assistance.

- Dynamic creative optimization (DCO) platforms can serve personalized ads across programmatic channels based on real-time churn scores.

These activations are tracked end-to-end, with closed-loop feedback ensuring that every intervention contributes to model improvement.

Real-World Impact: Case Studies from the Field

While the technology behind MinervaDB is sophisticated, the results are measured in straightforward business outcomes. Here are a few examples of how CPG brands have leveraged the platform to reduce churn and increase revenue per customer.

Case Study 1: National Snack Brand Reverses Declining Retention

A leading U.S.-based snack company was experiencing a steady decline in repeat purchase rates, particularly among younger consumers. Despite heavy investment in social media advertising and influencer partnerships, customer retention over six months had dropped from 42% to 36%.

After implementing MinervaDB, the brand gained visibility into previously hidden behavioral patterns. The platform revealed that a significant portion of churn was occurring among health-conscious millennials who were switching to plant-based or low-sugar alternatives.

Armed with this insight, the company launched a targeted re-engagement campaign featuring:

- A new line of baked, low-sodium snacks

- Personalized recipe ideas using their products

- A “try before you buy” sample program for at-risk customers

Within three months, repeat purchase rates among the target segment increased by 18%, and overall churn decreased by 11 percentage points. Additionally, cross-category sales (snacks paired with beverages) rose by 23% due to intelligent bundling recommendations.

Case Study 2: Global Beverage Company Boosts CLV Through Category Expansion

A multinational beverage brand wanted to increase customer lifetime value but struggled to move consumers beyond single-category purchases. Most customers bought either carbonated drinks or bottled water, but rarely both.

MinervaDB analyzed millions of transactions and identified a subset of customers who exhibited “hydration-seeking” behavior—buying sports drinks after gym check-ins, purchasing iced tea during heatwaves, and redeeming coupons for electrolyte products.

The brand used these insights to create a “Total Hydration” loyalty program, offering bonus rewards for purchasing across multiple beverage types. Personalized dashboards showed customers their hydration score, and automated reminders encouraged replenishment.

Over six months, the average number of categories purchased per customer increased from 1.4 to 2.1, and CLV rose by 29%. Churn rates among program participants dropped by 15%, as the expanded product relationship created stronger brand loyalty.

Case Study 3: Regional Dairy Producer Improves Retention in Competitive Market

A regional dairy company faced intense pressure from national brands and private labels. Customer loyalty was fragile, and price promotions were eroding margins without delivering sustained retention.

MinervaDB helped the company shift from a transactional to a relational model. By analyzing local purchasing patterns, the platform identified households that valued freshness, local sourcing, and sustainability.

The brand responded with a hyper-localized campaign highlighting farm-to-store timelines, carbon footprint data, and community involvement. At-risk customers received personalized videos from local farmers and invitations to farm tours.

The emotional connection drove a 22% improvement in six-month retention, and despite reducing discounting by 40%, revenue per customer increased by 17% due to higher basket sizes and reduced price sensitivity.

Building a Sustainable Data Culture

Technology alone cannot sustain long-term growth. MinervaDB recognizes that successful data strategy requires cultural transformation—embedding data-driven decision-making into the DNA of the organization.

To support this, the platform includes:

- Executive dashboards that translate complex metrics into actionable KPIs

- Department-specific workbenches for marketing, sales, product, and supply chain teams

- Automated reporting that delivers insights directly to stakeholders’ inboxes

- Training modules to upskill teams on data literacy and interpretation

By democratizing access to insights, MinervaDB ensures that data isn’t confined to a central analytics team but flows naturally into everyday decisions—from product development roadmaps to promotional calendars.

Future-Proofing the CPG Business

The future of CPG belongs to brands that can build deep, lasting relationships with consumers. In an era of infinite choice and fleeting attention, loyalty must be earned daily through relevance, value, and trust.

MinervaDB provides the strategic foundation for this new reality. By unifying data, predicting churn, and unlocking cross-category revenue potential, it enables CPG companies to move beyond short-term tactics and build enduring customer equity.

The platform is also designed to evolve. As new data sources emerge—connected appliances, voice assistants, wearable devices—MinervaDB can incorporate them seamlessly, ensuring that brands stay ahead of changing consumer behaviors.

Moreover, the system supports sustainability goals by reducing waste—both in marketing spend and physical inventory. By targeting the right customers with the right offers at the right time, brands minimize overproduction, unsold stock, and unnecessary promotions.

Conclusion: From Data to Growth

In the competitive landscape of the CPG industry, customer churn is not an inevitable cost of doing business—it’s a solvable problem. And increasing revenue per customer isn’t just about raising prices or pushing more units; it’s about deepening relationships and expanding value.

MinervaDB’s data strategy empowers CPG brands to do both. By transforming fragmented data into unified intelligence, turning hindsight into foresight, and unlocking cross-category opportunities, it delivers measurable impact on the bottom line.

The brands that will thrive in the next decade are those that treat data not as a byproduct of operations, but as a core strategic asset. With MinervaDB, CPG companies can turn that vision into reality—reducing churn, increasing revenue per customer, and building a foundation for sustainable growth.

Further Reading

- Data Strategy and Analytics

- Vector Data Engineering

- Data Architecture, Engineering, and Operations for E-Commerce and Retail

- Data Engineering and Analytics in the SaaS Industry: A MinervaDB Inc. Perspective

- Custom-Scoped Database Design and Performance Consulting: Transform Your Data Infrastructure with MinervaDB Inc.