Abstract

This white paper presents a detailed case study on the implementation of a Snowflake Data Mesh architecture for a leading international payment processing platform. Initially, the platform faced significant challenges with its legacy data architecture. This included siloed data, inconsistent governance practices, and latency issues affecting real-time fraud detection. To address these issues, the organization adopted a Data Mesh approach. This strategic move aimed to enhance data accessibility, improve analytics capabilities, and ensure compliance with global regulations. Throughout, this case study outlines the challenges faced, the strategic phases of implementation, and the resulting benefits achieved through this transformation.

Background

A leading international payment processing platform, handling over 3.5 billion transactions daily across 137 countries, faced critical challenges with its legacy data architecture. As the company rapidly expanded from regional operations to a global enterprise, it encountered significant data management complexities. With more than $7.8 trillion in annual transaction volume, this global payment processor urgently needed to transform its data infrastructure. The goal was to support 24/7 operations, deliver millisecond-level response times, and meet increasingly complex regulatory requirements.

Before the transformation, the platform operated a centralised data lake architecture that struggled with data freshness, cross-regional analytics, and the ability to serve diverse stakeholder needs. After careful evaluation of several architectural options, the organization’s leadership committed to a Data Mesh approach using Snowflake as the core platform. They launched a three-year digital transformation roadmap, backed by a $42 million investment, to drive this initiative forward.

Challenges

-

Siloed data across multiple regional systems: To begin with, the payment platform operated 17 distinct regional processing centers, each with independent data pipelines, schemas, and storage solutions. Cross-regional analytics required complex ETL processes with 72+ hour latency.

-

Inconsistent data governance practices: Each region maintained separate data dictionaries, quality standards, and access protocols. Consequently, 40% of analytics projects failing due to data inconsistencies and 65% of data scientists’ time spent on data preparation rather than analysis.

-

Latency issues affecting real-time fraud detection: Moreover, the existing batch-oriented architecture created 15-30 minute delays in fraud detection systems.This delay led to approximately $157 million in annual fraud losses that could have been prevented with real-time analytics.

-

Regulatory compliance requirements across 100+ countries: The payment processor needed to adhere to PCI-DSS, GDPR, CCPA, and dozens of country-specific regulations. As a consequence, the company incurred $12 million in compliance-related penalties in the year before the transformation began.

-

Scaling issues with traditional data warehouse architecture: Additionally, during peak processing periods (e.g., Black Friday, Cyber Monday), the system experienced 78% degradation in query performance and 23 critical outages in the previous year.

-

Limited domain expertise in centralized data teams: Lastly, the centralized data engineering team of 47 professionals couldn’t effectively support the specialized needs of 200+ internal data consumers across finance, risk, marketing, and operations departments.

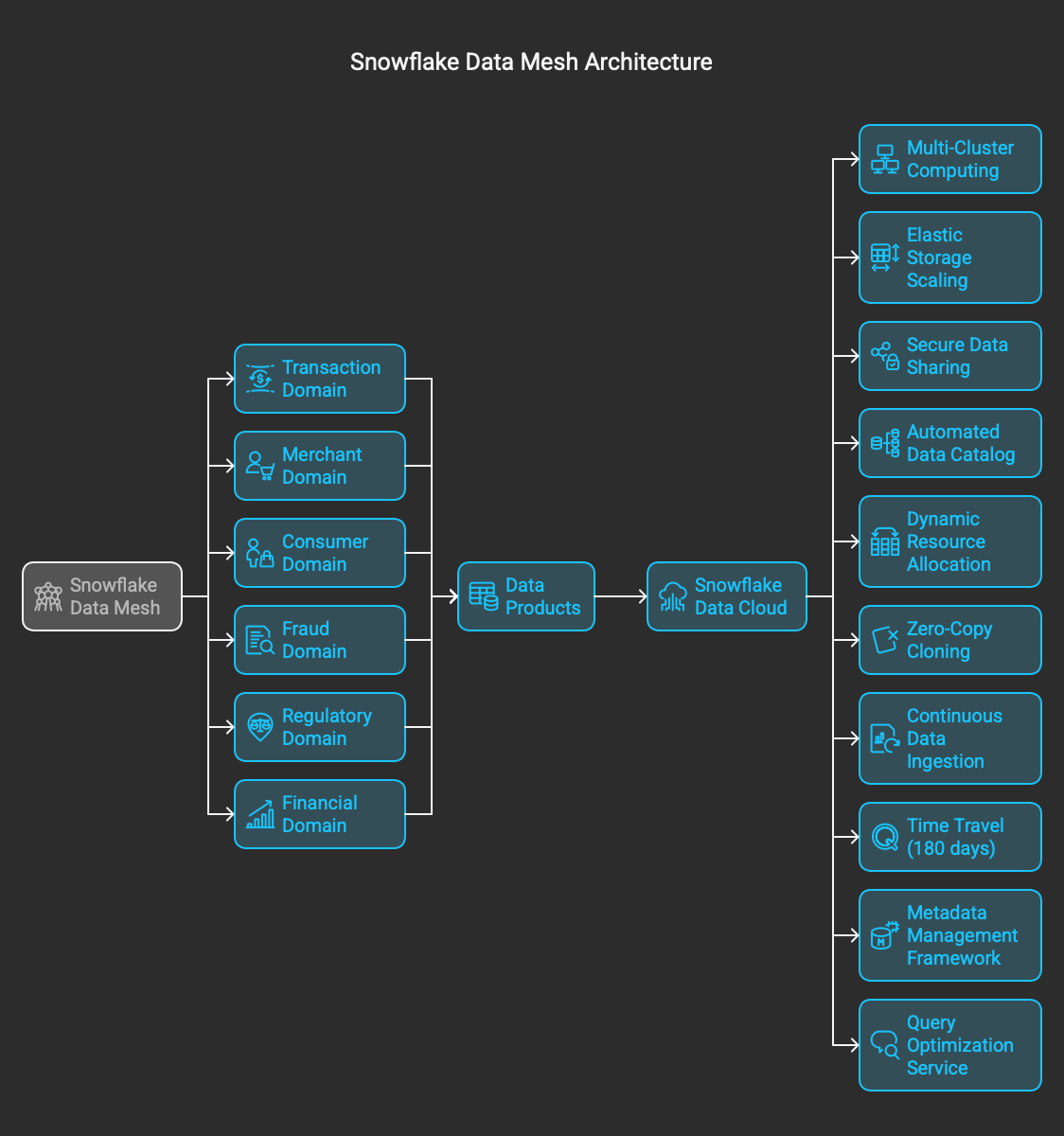

Solution: Snowflake Data Mesh Implementation

Phase 1: Domain Identification and Organization (Months 1-4)

The payment platform conducted a comprehensive domain analysis using event storming workshops and data flow mapping exercises, identifying six key domains:

-

Transaction Processing Domain: Responsible for core payment authorization, clearing, and settlement data

-

Merchant Services Domain: Managing merchant onboarding, performance analytics, and fee structures

-

Consumer Banking Domain: Handling cardholder data, account management, and consumer behavior analytics

-

Fraud Detection Domain: Developing and operating real-time fraud prevention systems and risk scoring

-

Regulatory Compliance Domain: Ensuring adherence to global financial regulations and reporting requirements

-

Financial Reporting Domain: Producing financial statements, reconciliation data, and business performance metrics

Each domain was structured as a “data product team” with:

-

3-5 data engineers

-

2-3 domain subject matter experts

-

1-2 analytics specialists

-

1 product owner

-

Part-time compliance and security specialists

The company implemented a matrix organizational structure where domain teams maintained functional reporting lines while being accountable to a central Data Governance Council for standards and interoperability.

Phase 2: Technical Architecture (Months 3-9)

Key technical components implemented:

-

Domain-specific Snowflake databases with independent compute resources: Each domain operated dedicated Snowflake warehouses tailored to its workload needs. These warehouses ranged from XS to 4XL in size, depending on compute requirements.

For example, the Transaction domain used Snowflake’s multi-cluster warehouses with auto-scaling enabled from 1 to 16 clusters.Consequently, the system efficiently handled peak processing periods without compromising performance. -

Snowflake Data Sharing for cross-domain data access: The team implemented 27 secure data shares between domains with strict read-only access controls. In addition, they enabled automated usage tracking to monitor data access patterns.

As a result, they eliminated 89% of legacy ETL processes. This also reduced cross-domain data latency dramatically—from hours to just seconds. -

Snowflake Data Marketplace for third-party data integration: Integrated 14 external data sources including currency exchange rates, merchant risk scores, and global sanctions lists through Snowflake Data Marketplace, reducing third-party data onboarding time from weeks to days.

The architecture integrated 14 external data sources using the Snowflake Data Marketplace. These sources included currency exchange rates, merchant risk scores, and global sanctions lists.

Consequently, the onboarding time for third-party data dropped from weeks to just days, accelerating time-to-insight. -

Snowpipe for continuous data ingestion: Deployed 142 Snowpipe pipelines processing 18TB of data daily with sub-minute latency, replacing batch-oriented loads. Implemented with AWS SQS for notification-driven ingestion and Azure Event Hubs for real-time transaction streams.

-

Time Travel and Zero-Copy Cloning for compliance and testing: Configured 180-day Time Travel retention for critical datasets, enabling point-in-time recovery and audit capabilities. Created 300+ zero-copy clones for testing environments, saving 85TB of duplicate storage and reducing environment provisioning time from days to minutes.

The architecture leveraged Snowflake’s multi-cloud capabilities, with primary deployment on AWS and disaster recovery on Azure, providing 99.999% availability through cross-cloud failover capabilities.

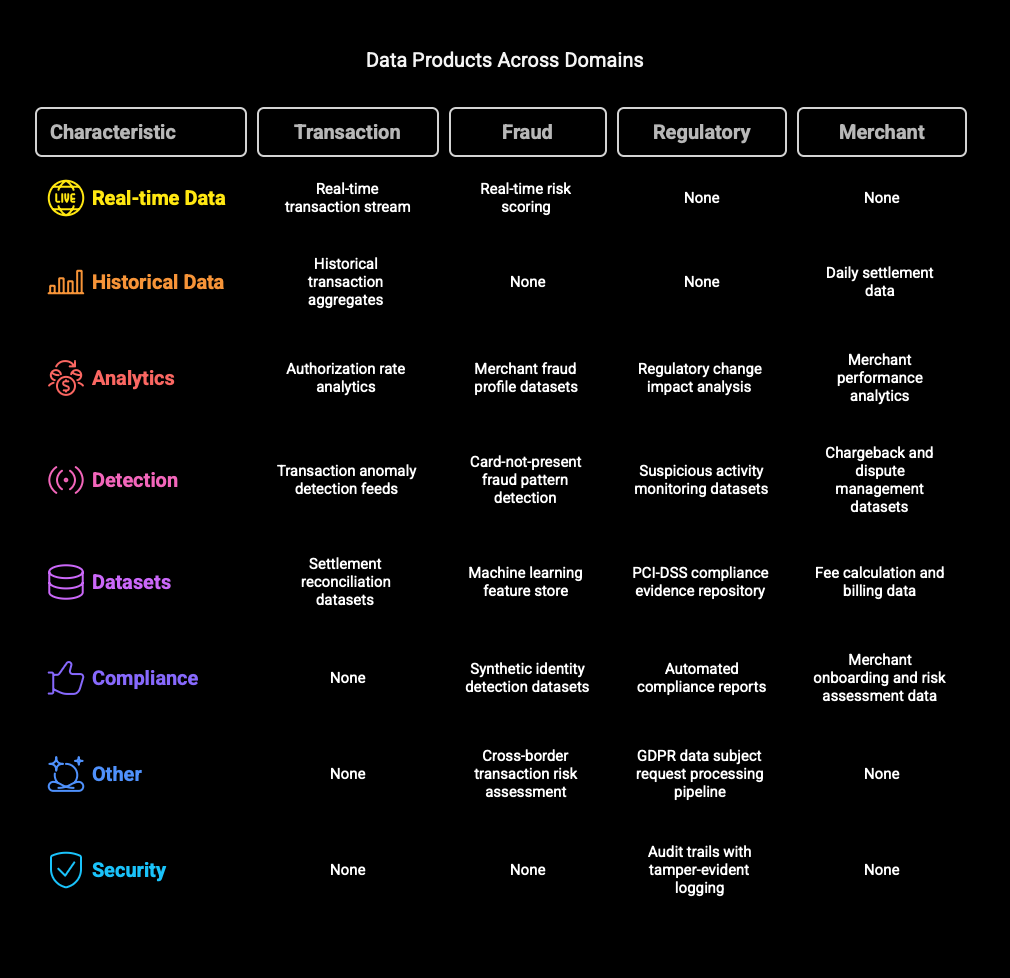

Phase 3: Data Product Development (Months 6-15)

Each domain team developed standardized data products following a product management approach:

-

Transaction Domain Data Products:

-

Real-time transaction data stream (latency <2 seconds)

-

Historical transaction aggregates with 24-month retention

-

Authorization rate analytics by region, card type, and merchant category

-

Settlement reconciliation datasets with automated balancing checks

-

Transaction anomaly detection feeds

-

-

Fraud Domain Data Products:

-

Real-time risk scoring models with 200+ variables

-

Merchant fraud profile datasets updated hourly

-

Card-not-present fraud pattern detection

-

Cross-border transaction risk assessment

-

Machine learning feature store with 1,000+ fraud indicators

-

Synthetic identity detection datasets

-

-

Regulatory Domain Data Products:

-

Automated compliance reports for 37 regulatory bodies

-

Suspicious activity monitoring datasets

-

PCI-DSS compliance evidence repository

-

GDPR data subject request processing pipeline

-

Audit trails with tamper-evident logging

-

Regulatory change impact analysis datasets

-

-

Merchant Domain Data Products:

-

Daily settlement data with T+1 reconciliation

-

Merchant performance analytics by location, category, and time

-

Chargeback and dispute management datasets

-

Fee calculation and billing data

-

Merchant onboarding and risk assessment data

-

Each data product included:

-

Standardized documentation in Snowflake’s Data Catalog

-

SLAs for freshness, completeness, and accuracy

-

Self-service access through domain-specific data marts

-

Automated quality monitoring with alerting

-

Version control and change management processes

Phase 4: Governance Framework (Months 4-18)

Implemented a federated governance model with:

-

Global data standards and schemas: First, the team Created standardized data definitions and schemas across all domains to ensure consistency and interoperability.

-

Data stewardship roles: Next, appointed data stewards within each domain responsible for data quality, governance, and compliance.

-

Automated compliance checks: In addition, developed automated processes to monitor adherence to regulatory requirements and internal data governance policies.

-

Regular audits and reviews: Finally established a schedule for regular audits of data products and governance practices to ensure ongoing compliance and quality.

Conclusion

The implementation of a Snowflake Data Mesh architecture significantly transformed the payment processing platform’s data capabilities. As a result, the organization overcame challenges related to siloed data, inconsistent governance, and latency issues. By doing so, it improved data accessibility and enabled real-time analytics. It also strengthened compliance with global regulations.

Ultimately, this case study highlights the potential of adopting a Data Mesh approach in large-scale data environments. It sets the stage for future innovations in data management and analytics.

Further reading

TiDB Selection Framework for Enterprise Architecture

Tuning TiDB Server Parameters for Optimal Performance

Galera Cluster for MySQL 8.0.42-26.23 and 8.4.5-26.23

Building Horizontally Scalable RDS Infrastructure

Vector Index Algorithms in Milvus